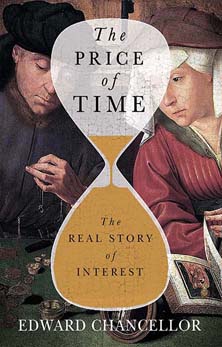

The Price of Time : The Real Story of Interest

সর্বাধিক বিক্রিত বই

Loading popular products...

|

Title |

The Price of Time : The Real Story of Interest |

|

Author |

Edward Chancellor |

|

Publisher |

Atlantic Books |

|

Number of Pages |

398 |

|

Language |

English (US) |

|

Category |

|

|

First Published |

JAN 2022 |

Delivery Charge (Based on Location & Book Weight)

Inside Dhaka City: Starts from Tk. 70 (Based on book weight)

Outside Dhaka (Anywhere in Bangladesh): Starts from Tk. 150 (Weight-wise calculation applies)

International Delivery: Charges vary by country and book weight — will be informed after order confirmation.

3 Days Happy ReturnChange of mind is not applicable

Multiple Payment Methods

Credit/Debit Card, bKash, Rocket, Nagad, and Cash on Delivery also available.