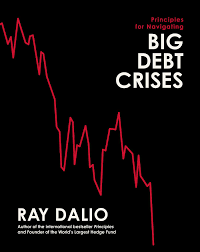

Ray Dalio, the legendary investor and international bestselling author of Principles - whose books have sold more than five million copies worldwide - shares his unique template for how debt crises work and principles for dealing with them well. This template allowed his firm, Bridgewater Associates, to anticipate 2008’s events and navigate them well while others struggled badly.

As he explained in his international bestseller Principles, Ray Dalio believes that almost everything happens over and over again through time, so that by studying patterns one can understand the cause-effect relationships behind events and develop principles for dealing with them well. In this three-part research series, he does just that for big debt crises and shares his template i..

Delivery Charge (Based on Location & Book Weight)

Inside Dhaka City: Starts from Tk. 70 (Based on book weight)

Outside Dhaka (Anywhere in Bangladesh): Starts from Tk. 150 (Weight-wise calculation applies)

International Delivery: Charges vary by country and book weight — will be informed after order confirmation.

3 Days Happy ReturnChange of mind is not applicable

Multiple Payment Methods

Credit/Debit Card, bKash, Rocket, Nagad, and Cash on Delivery also available.